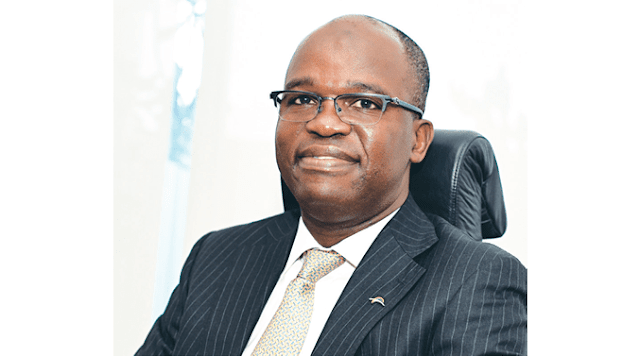

Global Shame! Former NAPIMS boss, Dafe Sejebor, Arrested In Sex Trafficking Sting In The US

A crook and contempt are friends. The shady character excites the scornful tribute of a sneer every time the discussion segues to him. More often than not, the crooked man despoils and looms in the public’s consciousness, like a troll from a medieval horror. Consider the case of Dafe Sejebor, the former Group General Manager (GGM) of the National Petroleum Investment Management Services (NAPIMS) for instance, due to his perceived crookedness, he has been arrested alongside 46 others in a sex trafficking sting in the U.S. The sting conducted by multiple law enforcement agencies, including the Katy Police Department, resulted in the arrests of 47 people on human trafficking charges, officials announced in a Wednesday morning news conference. Houston Police Sgt. John Wall said the sting operation ran from March 19-29 in the Katy area and Fort Bend County. Wall said of the 47 arrests, 27 were female and 20 were male. Eight were charged with human trafficking-related offense